Performance Bond

Contract Surety Bond Facility

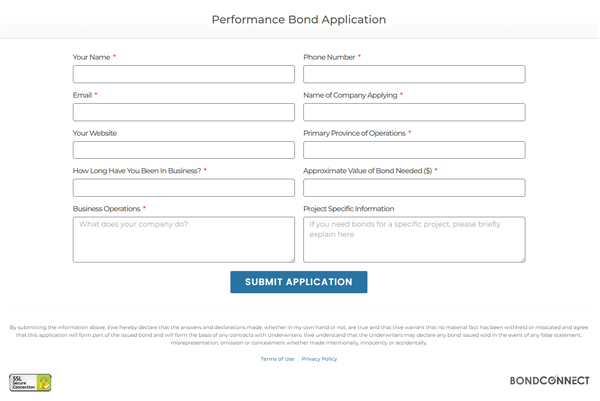

If you are required to provide a Performance Bond for a newly acquired contract, then you’ve come to the right place! We provide complete contract bonding services to clients of all types. From large scale construction contractors, to a recycling firm that has picked up a municipal service agreement, and more. In order to provide a Performance Bond, you’ll need to have a Bond Facility setup. Learn more below and apply to get a performance bond today!

What is a Performance Bond?

A Performance Bond is a security instrument that guarantees the performance of a contract on behalf of the “Principal” (the party taking on the agreement) in accordance with the terms, conditions, and specifications agreed upon in the contract documents. Contractual obligations often dictate Performance Bonds are issued simultaneously with Payment Bonds.

This type of bond is typically in the amount of either 50% or 100% of a contract value and is in place for the duration of work being done with a standard 1 or 2 year maintenance period, depending on requirements. Performance Bond’s protect the contract owner (also called an “Obligee”) by having a third party Surety Company guarantee the acceptable performance of said contract. It allows an Obligee to make a claim under the bond should the hired contractor not perform adequately.

Performance Bond guarantees issues by surety bond companies ensures project owners that they’ll be financially protected in the unlikely event that a hired contractor fails.

Why do I need a Performance Bond?

In the event you would like to take on a project that requires a Performance and / or L&M Payment Bonds for the project owner, it’s necessary for your business to have a Bond Facility setup. This is the Underwriting process we go through prior to your company having the capability of providing Surety Bonds. With this financial guarantee backed by a licensed Canadian Surety Company, you can be certain that you’ll be able to take on whatever work is of interest, regardless of bonding requirements.

As an overview, a performance bond protects owners from contractor defaults on their construction projects, or in another industry.

Is a Performance Bond a Contract Bond?

Yes. Performance Bonds are contract bonds issued to a project owner from surety bond companies often in conjunction with a Payment Bond. Perf & Payment Bond guarantees frequently are issued on construction projects where a Bid Bond was requested during the tender phase of a construction contract.

The time frame for obtaining contract surety bonds for the first time is approximately 1 week. The majority of this time will be the process of getting together documentation that is requested from the bond company and if they are higher risk bonds. This can sometimes be done in a shorter time-frame, or could take longer depending on the complexity of your business.

What are the qualifications required for Performance Bonds?

Performance Bonds are underwritten by a bond company through your surety broker (that’s us!). This underwriting process is part of a formal agreement called a bonding facility where your business can provide the bonds needed if and when they’re required.

As your surety broker we’ll be reviewing recent financial statements, corporate history, and personal financial strength to ensure you qualify for performance bonds or any other bonds needed.

How much does a Performance Bond cost?

A Performance Bond’s cost will depend on various factors and is stated in the terms & conditions of your Bond Facility once it has been setup.

It is common for a Performance Bond to be issued in collaboration with a Labour & Material Payment Bond as well. Standard amounts and contract requirements in Canada dictate that a 50% Performance Bond and 50% Labour & Material Payment Bond are often the go-to security for those seeking bonding as a form of risk mitigation. These, so-called 50/50 Bonds have a standard rate of $10 / $1,000 of contract value; therefore, you can determine these bonds will cost approximately 1% of a contracts value. However, it’s important to note that contractors obtaining bonding for the first time typically have a higher rate than this in the $15 / $1,000 range and depending on industry and financial position, can even reach a rate of $25+.

As your Surety Bond Broker, we aim to obtain bond rates for you as low as possible and have a successfully track record of negotiating rates for clients that qualify (pending financial strength and experience).

It’s also important to mention that the ability to obtain any contract bonds in general is part of a form of annual subscription called a Bond Facility which costs vary, but are in the range of $3,000 per year.

Surety Bond Rate Calculator

Based on a CCDC standard 50% Performance Bond and 50% Labour & Material Payment Bond with a 1 year warranty term.

1 month

Please note, this calculator is based on a $12.50 / $1,000 bond rate which is common for new bond facilities; however, this amount can be more or less depending on various aspects of your business and contract specifics. This rate calculator is for estimation purposes only.

What types of businesses can we provide Performance Bonds for?

We provide contract bond services including the capability of issuing Performance Bonds to contractors of all types. These include:

General Contractors

Municipal Contractors

Road Builders / Pavers

Bridge Builders

Electrical Contractors / Electricians

Plumbers & HVAC Contractors

Site Servicing Contractors

Infrastructure Contractors

Landscape Contractors / Landscapers

Roofing Contractors

Drywall Contractors

Glass Installers

Developers

Garbage Disposal Contractors

Recycling Contractors

and more...

Many of the industries mentioned above fall under Construction Bonds, but we’re able to facilitate bond requirements for all types of companies.

What other kinds of bonds are available?

Besides a Performance Bond, the typical Surety Bond requirements can almost all be provided through your Bond Facility, these include but are not limited to:

E-Bonding

We always have the ability of providing verified “E-Bonding” in compliance with the Surety Association of Canada’s required criteria outlined here.

Issue Performance Bonds needed by your company

Issue Tender Bonds like Bid Bonds

Reliable Canadian Underwriters

Certified E-Bonds

Annual Bond Facility

Bid Bond vs Performance Bond: Key Differences

This article will delve deep into the nuances of a Bid Bond vs Performance Bond, highlighting their key differences, real-world applications, and their broader implications

How Does A Bond In Construction Work?

In the realm of construction, where every project stands as a testament to innovation and collaboration, the shadows of uncertainty and risk linger. Enter surety